Paycom vs Paycor (2023): Payroll Software Comparison

Paycom and Paycor are two popular software solutions that combine payroll with a variety of HR tools. Not only are their names so similar they only differ by one letter, their features are also a close match as well — but there are some key differences between these platforms.

In this comparison, we’ll dive into these two solutions to help you determine which one is a better fit for your business.

Jump to:

Paycom vs. Paycor: Comparison table

| Features | Paycom | Paycor |

|---|---|---|

| Starting price per month | Custom quote | Custom quote |

| Expense management | Yes | Yes |

| Benefits administration | Yes | Yes |

| HR tools | Yes | Yes |

| Free trial | No | Yes |

1

QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

3

Justworks

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.

Paycom and Paycor pricing

Paycom pricing

To get pricing with Paycom, you’ll have to first contact its sales team to schedule a demo — which means there isn’t a free trial for you to try out the software yourself. After the demo, you’ll get a tailored quote based on your business’s particular needs.

However, to get some idea on estimated costs, take a look at our Paycom review.

SEE: The Top Paycom Competitors and Alternatives for 2023

Paycor pricing

Paycor does not disclose its pricing on its website. Its pricing page does say that it offers four different tiered plans — Basic, Essential, Core and Complete — for businesses with less than 50 employees. However, it doesn’t actually state what the costs are for each plan, so you will need to reach out to them for a pricing quote. Businesses with more than 50 employees will also need to contact Paycor for a custom quote. However, a free trial is available so you can try before you buy. See our full Paycor review for more information.

SEE: The Best Payroll Software for Manufacturing in 2023

Feature comparison: Paycom vs. Paycor

Payroll processing

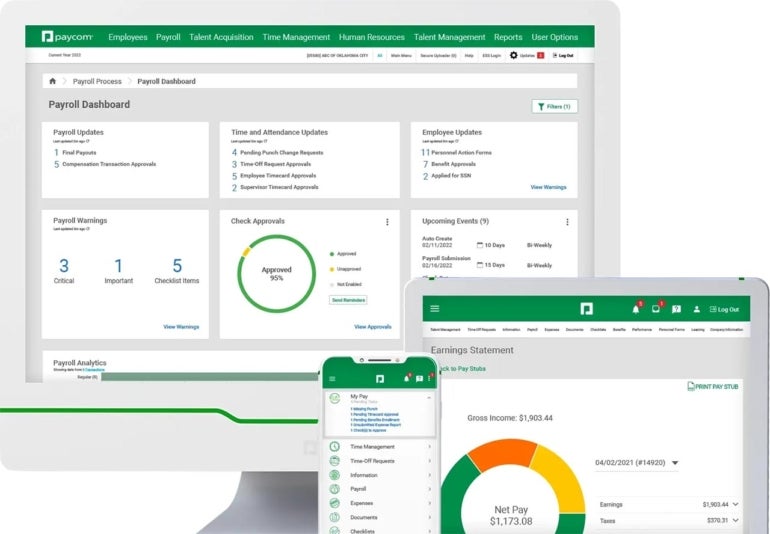

With Paycom’s payroll solution (Figure A), you’ll have access to automatic deductions, tax filing and withholding features and paid holiday tracking — among other capabilities. Paycom also provides direct deposit as well as payroll cards, and it has an automated payroll assistant named Beti that employees can use to verify and troubleshoot their own payroll. Additionally, the software will take care of general ledger data, payments, record keeping, payroll taxes and garnished wage calculations on your behalf so you can focus on other facets of your business.

Figure A

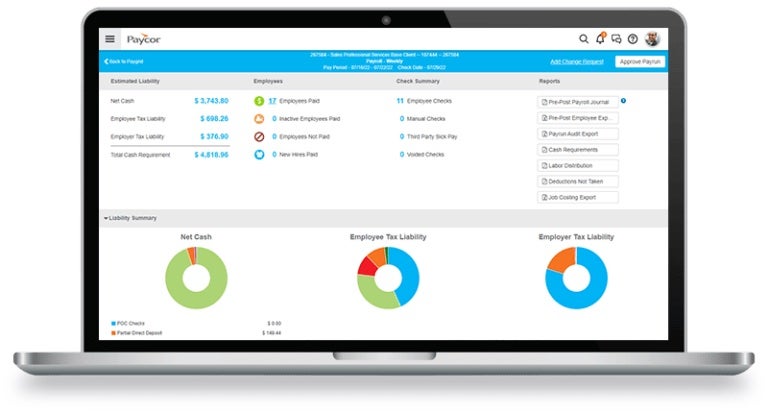

Paycor’s payroll and tax features (Figure B) include federal & state tax filing, direct deposit, check stuffing, employee self-service and new hire filing. You can also set up the AutoRun feature to process payroll on a specific day and time even if you won’t be at the computer that day. All changes are made in real-time, so you don’t have to wait for calculations to process, speeding up payroll. These comprehensive payroll features will satisfy most small and midsize businesses, though they might not be robust enough for enterprise businesses with very complex payroll needs.

Figure B

On the mobile front, both options have mobile apps for Android and iOS, though their capabilities vary.

SEE: The Best Payroll Apps for 2023

Expense management

By linking to company credit cards or pulling information from uploaded receipts, Paycom can automatically pull in expense data and sort it within your general ledger. It also has a helpful mileage tracking feature to ensure you have the most accurate details for expense management and reporting. With so much automation, you can minimize errors and free up your time to handle other tasks.

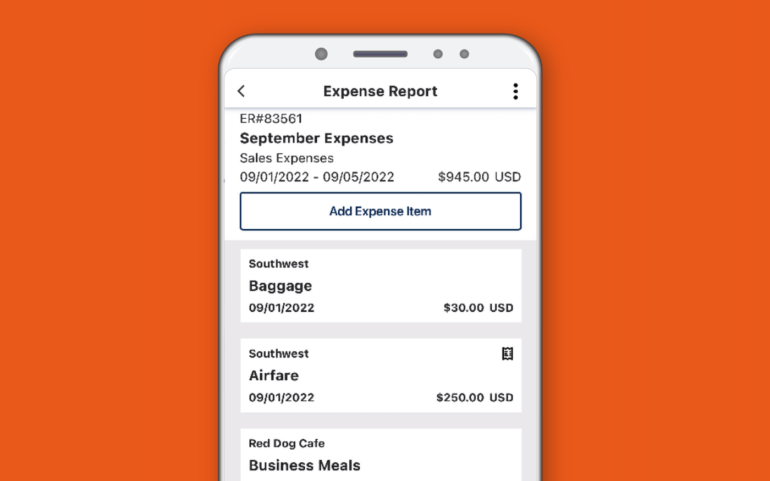

Paycor also lets employees take pictures of receipts or submit expenses on the mobile app (Figure C). The mobile app will also track automobile trip data, including date, distance and duration. Meanwhile, expenses categories can easily be created, edited or removed to fit the changing needs of your business.

SEE: The Best Payroll Software for Your Small Business in 2023

Figure C

Benefits administration

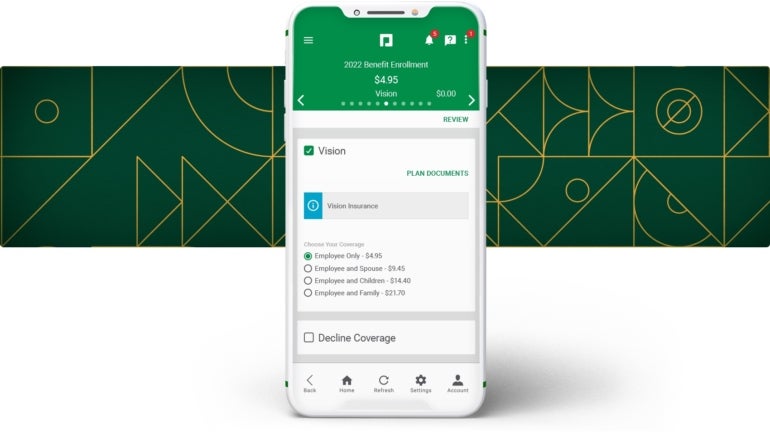

Paycom can help keep you compliant with HIPAA, COBRA and other regulations through automated benefits enrollment — and its self-service employee app (Figure D) can further simplify the selection process for workers on both mobile and desktop. To keep benefits information in one place, Paycom provides a Benefits to Carrier tool, and you can opt to add a Paycom benefits coordinator to your services for additional assistance.

Figure D

If your HR department dreads Open Enrollment, Paycor’s benefits add-on can help streamline the process thanks to automated workflows. The platform also offers EDI connections that deliver enrollment data to nearly all major insurance carriers. Meanwhile, pay-as-you-go automatic insurance payments ensure that you stay on top of worker’s compensation throughout the year.

Talent management

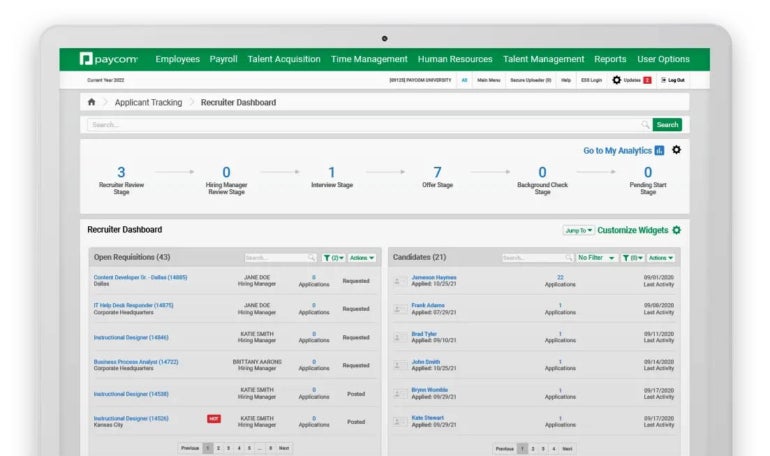

To keep your hiring process tidy, Paycom offers talent acquisition tools (Figure E) that can help you move qualified and capable candidates through more quickly without much manual work. You can also vet employees with its e-verify system, which runs background checks and ensures applicants are eligible for various roles. Additionally, Paycom has tools for learning management, compensation budgeting and performance management for hired employees.

SEE: The Top 6 Compensation Management Software Choices for 2023

Figure E

Paycor also offers plenty of talent management tools, including a candidate dashboard that centralizes everything in one place and the ability to create custom hiring workflows. AI-powered tools help hiring teams write job descriptions and source candidates with less effort, while industry-specific onboarding tools help new hires view and sign important company documents.

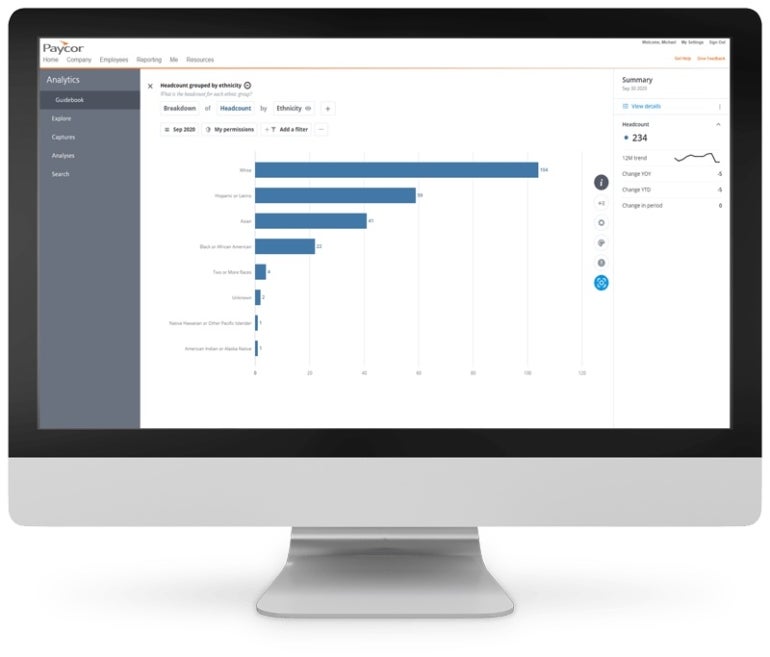

The Talent Rollout page serves as a hub for performance review templates and notes, and the compensation management tool flows into the people analytics reporting to ensure you’re creating competitive packages. These robust reporting capabilities (Figure F) are why we named Paycor one of our best payroll software for accountants.

Figure F

Paycom pros and cons

Pros of Paycom

- Intuitive Android and iOS mobile apps.

- Employee self-service options.

- Helpful learning management system.

- Employee performance management and compensation budgeting features.

Cons of Paycom

- No free trial and no transparent pricing.

- May be too expensive for small businesses.

- Limited third-party integrations.

Paycor pros and cons

Pros of Paycor

- Multiple paid plans to suit different budgets.

- Unlimited payroll runs and automated payroll.

- Custom reporting and analytics.

- Self-service employee portal.

Cons of Paycor

- Pricing structure is not transparent.

- Charges additional fees for certain payroll actions like check stuffing.

- Multiple features, like benefits and time tracking, are extra add-ons.

Methodology

For this review, we looked at product sites, product videos, aggregated user reviews and software documentations. We took a careful look at payroll processing capabilities, HR features, pricing and more.

Should your organization use Paycom or Paycor?

Paycom and Paycor are both solid payroll solutions with HR features weaved in.

Paycom is more fitting for midsize or large businesses that need both payroll and human capital management (HCM) features. It may be too expensive for smaller companies, and it may be too robust for businesses with simpler needs.

Paycor offers many of the same features as Paycom, but a lot of them — including worker’s comp, time and attendance, benefits administration and recruits — are extra add-ons, which will presumably hike up the price. However, because of the lack of pricing transparency, it’s difficult to compare Paycom and Paycom directly when it comes to affordability. We do like that Paycor offers a free trial, which is a big differentiator from Paycom.

Both platforms also offer guided demos, and you’ll need to contact the sales team anyways to get a pricing quote for either one. Since these platforms are so similar, you should come to the demo prepared with specific questions about your business’ individual use case.

But if you find that neither Paycom or Paycor are right for your business, there are plenty of other options to consider. Take a look at our favorite payroll software in 2023 to see what else is out there.

1

QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

3

Justworks

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.

4

OnPay

Payroll and HR that move you in the right direction. We give you everything you need to navigate payroll, HR, and benefits — so you can keep running your business smoothly.

Get your first month free, or join a demo to see everything we can do!

5

Paychex

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).

Source: News