The Top 6 Paychex Competitors and Alternatives for 2023

Paychex is a prominent payroll and HR service that serves small, midsize and large businesses as well as some enterprises. Its payroll software, PEO service and thorough HR tools make it a top pick for businesses that want scalable payroll plans with plenty of HCM options. Still, Paychex’s price or features might not be the right fit for your company. If so, you have several top-notch Paychex competitors to choose from.

Gusto is the best Paychex alternative for most businesses, especially small and midsize businesses that want fully automated payroll and some HR support.

Below, we explain what sets Gusto apart and review five other key Paychex competitors to help you find the best payroll and HR product for your business.

Jump to:

Top Paychex competitors and alternatives: Comparison table

| Feature | Paychex | Gusto | QuickBooks | Justworks | Rippling | ADP | BambooHR |

|---|---|---|---|---|---|---|---|

| Global payroll | Third-party service | Contractors only | No | No | Yes | Yes | No |

| Benefits administration | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| HR tools | Yes | Yes | Limited | Yes | Yes | Yes | Yes |

| Hiring and onboarding | Yes | Yes | Limited | Yes | Yes | Yes | Yes |

| Mobile app for employers | Yes | No | No | No | Yes | No | No |

| Integrations | 90+ | 180+ | QuickBooks ecosystem | Limited | 500+ | 50+ | 120+ |

Top Paychex competitors

Gusto: Best overall Paychex alternative

Our star rating: 4.6 out of 5

Gusto, an all-in-one payroll, benefits and HR platform, is a formidable Paychex competitor, delivering an array of services tailored to small and medium-sized businesses. Even though Gusto is a relatively new player in the payroll and HCM market (especially compared to Paychex, which has been around for 50 years), Gusto has rapidly become the go-to choice for companies seeking a user-friendly and cost-effective payroll solution.

While Gusto and Paychex offer the same thorough payroll automation, Gusto does more for less. For instance, all Gusto plans include accounting software integration, W-2/1099 distribution and benefits integration and administration. Paychex, in contrast, either charges an additional fee for each service or restricts it to higher-tier plans.

However, although Gusto beats out Paychex in terms of affordable payroll, Paychex has more HR features. Gusto restricts HR library access and compliance updates to its most expensive plan, but Paychex includes access to its comprehensive library of HR templates, documents and guides with each plan.

Get more details on how Gusto stands out by reading our Gusto review.

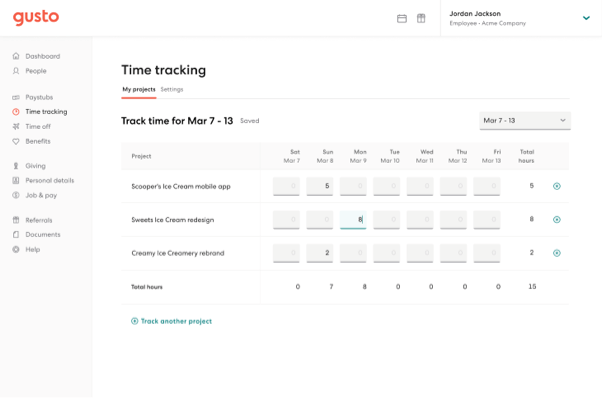

Figure A

Key features of Gusto

- Full-service payroll migration and account setup.

- Comprehensive multi-state payroll, including W-2s and 1099s.

- Exclusive contractor-only plan.

- Employee portal with lifetime access to pay stubs, W-2s, hours worked, etc.

- Integration with QuickBooks, Xero, FreshBooks, Clover, Shopify and more.

- Benefits administration, including health, wellness, retirement, transportation, housing and custom benefits.

Gusto pricing

Gusto provides three affordable plans:

- The Simple plan costs $40 per month plus $6 per month per employee.

- The Plus plan costs $60 per month plus $9 per month per employee.

- A Premium pricing plan is available upon request.

| Gusto pros | Gusto cons |

|---|---|

| Comprehensive payroll automation. | No free trial. |

| Scalable (three plans). | No mobile app for employers. |

| Global contractor payroll plan. | Limited HR features. |

| Integration with popular third-party business software. |

QuickBooks Payroll: Best for QuickBooks users

Our star rating: 4.1 out of 5

Do you use QuickBooks Online to track your company’s finances? Intuit’s payroll product, QuickBooks Payroll, could be a good Paychex alternative if you like QuickBooks Online’s functionality, user interface and data flow.

QuickBooks Online Payroll syncs perfectly with its cloud-based accounting counterpart, ensuring that every time you process payroll, your books update automatically. You’ll always have the most up to date financial data at your fingertips, and it’s hard to beat the convenience of managing your finances, payroll and taxes on the same user-friendly platform.

However, compared to Paychex, QuickBooks Payroll’s HR features are quite limited. If you opt for QuickBooks Online Payroll over Paychex, note that you’ll likely need another application entirely to manage HR.

Learn more by reading our QuickBooks Payroll review.

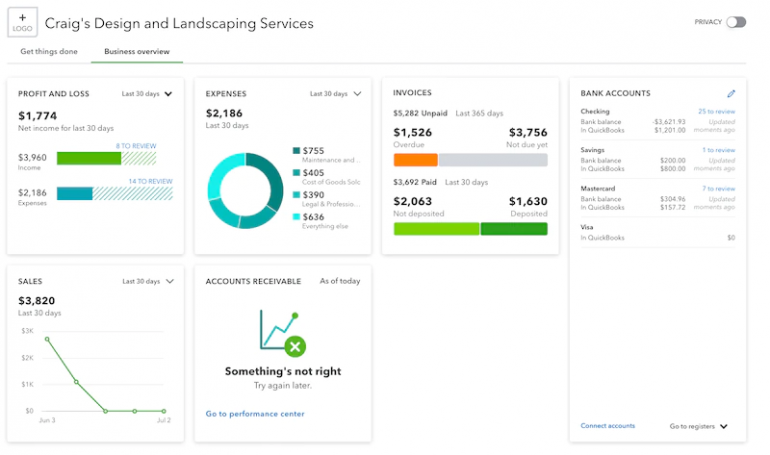

Figure B

Key features of QuickBooks Payroll

- Automatic direct deposit.

- Accounting and payroll integration.

- Tax filing and payments for federal, state and local taxes.

- Employee and contractor payment options.

QuickBooks Payroll pricing

QuickBooks has three payroll plans:

- QuickBooks Payroll Core costs $45 per month plus $6 per payee.

- QuickBooks Payroll Premium costs $80 per month plus $10 per payee.

- QuickBooks Payroll Elite costs $125 per month plus $12 per payee.

New QuickBooks Online Payroll users can sign up for a one-month free trial or opt for 50% off for three months, which lowers the starting price to $22.50 plus $6 per payee.

| QuickBooks Payroll pros | QuickBooks Payroll cons |

|---|---|

| Three scalable plans. | Limited HR features. |

| Optional 30-day free trial. | No time tracking with cheapest plan. |

| Seamless QuickBooks Online syncing. | Limited third-party integrations. |

| Support for W-2 employees and 1099 contractors. | Customer service complaints. |

Justworks: Best PEO option

Our star rating: 4.2 out of 5

Justworks is a professional employer organization (PEO) designed to help businesses manage payroll, HR, benefits and compliance all in one place. With its focus on simplicity and transparency, Justworks aims to provide growing businesses with a streamlined solution that combines essential tools and features.

As a PEO, Justworks acts as a co-employer with your company to take over employee compensation and benefits. It’s fairly comparable to Paychex PEO, offering similar full-service payroll, compliance alerts and benefits integration. Like Paychex PEO, Justworks is a pricier solution than most base-level payroll/HR software solutions. But since the company will tackle employee payroll, HR and benefits enrollment on your behalf, it frees up valuable time for business owners to spend on other projects.

Learn more by reading our Justworks review.

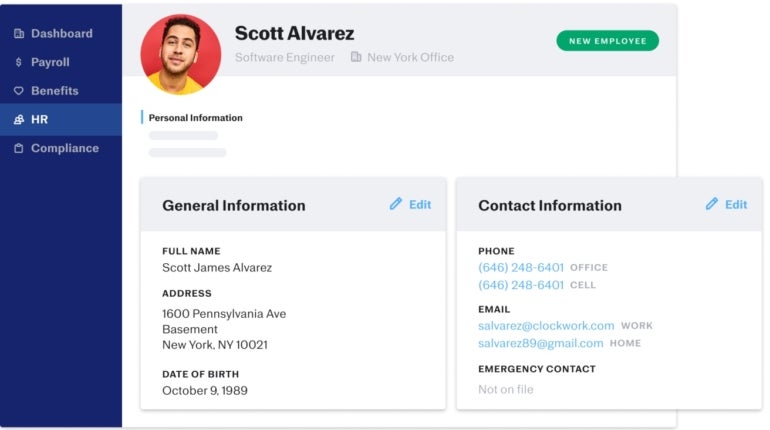

Figure C

Key features of Justworks

- Full-service payroll processing.

- Direct deposit and check payment options.

- Benefits administration, including health insurance, retirement and commuter benefits.

- HR tools for managing policies, time off and employee documentation.

- Compliance support, including tax filings and reporting.

- Onboarding and employee self-service portal.

- Integration with popular accounting software.

Justworks pricing

Justworks offers pricing based on the number of employees and the selected plan:

- Basic plan starts at $59 per employee per month.

- Plus plan starts at $99 per employee per month.

The price decreases by $10 per employee per month from your 50th employee onward.

Justworks also offers a time-tracking product, Justworks Hours, that costs $8 per user per month.

| Justworks pros | Justworks cons |

|---|---|

| Outsourced payroll and HR solution. | Limited third-party integrations. |

| Transparent online pricing. | Health benefits limited to pricier plan only. |

| User-friendly interface. | Extra fee for time-tracking. |

| Accounting software integration. |

Rippling: Best for growth

Our star rating: 4.3 out of 5

Rippling is a cloud-based platform designed to help businesses manage payroll, HR, benefits and IT in a single system. Its payroll and HR modules support businesses of all sizes and include full-service payroll with federal, state and local tax management.

Rippling’s excellent automations and built-in workflows make it easy to process payroll without much manual data entry. Rippling also has an optional global payroll product that helps businesses hire and pay contractors and employees in 50 countries. (Paychex also offers international payroll through its third-party partner, Blue Marble.)

While Rippling’s payroll module works well as a standalone product for businesses with one to ten employees, you’ll get more out of Rippling if you bundle its payroll and HR modules with its finance and IT modules. You can build your own total-business management platform from the ground up, using Rippling to manage nearly every aspect of your business.

Learn more by reading our Rippling review.

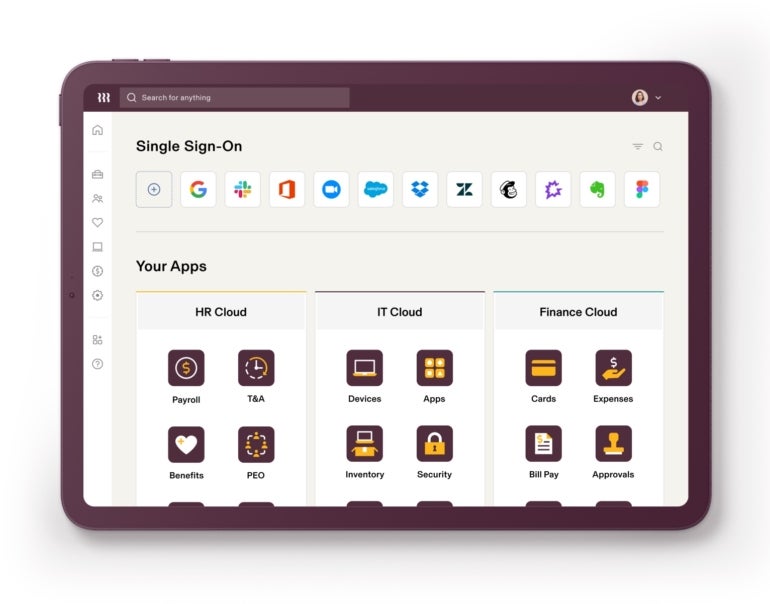

Figure D

Key features of Rippling

- Payroll processing and tax filing.

- Direct deposit and check payment options.

- Benefits administration, including health insurance, retirement plans and more.

- HR tools for managing time off, employee documentation and compliance.

- IT management features, such as device provisioning and software deployment.

- Onboarding and offboarding automation.

- Integration with various business apps and accounting software.

Rippling’s pricing

Pricing for Rippling’s payroll plan starts at $8 per user per month plus a custom monthly base fee. Rippling offers customized pricing based on the specific needs and size of the business. For detailed pricing information, businesses are advised to contact Rippling directly for a personalized quote.

| Rippling pros | Rippling cons |

|---|---|

| Comprehensive business management. | Limited transparent pricing online. |

| Customizable packages for maximum scalability. | Steep learning curve for new users. |

| Excellent automations and pre-built workflows. | May be too pricy for small businesses. |

| Fully featured payroll and HR modules. |

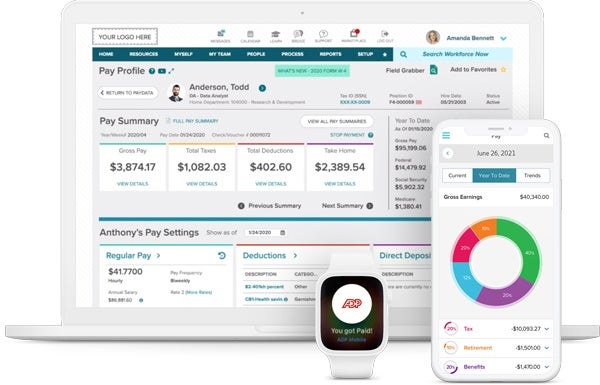

ADP RUN: Best for HR + payroll bundles

Our star rating: 4.4 out of 5

ADP is a global provider of payroll and HR solutions, offering a wide range of products, tools and services to help businesses manage their workforce. With a focus on flexibility and scalability, ADP is designed to adapt to the changing needs of organizations of all sizes.

Like Paychex, ADP offers both a payroll/HR software product (RUN Powered by ADP) and a PEO product (ADP TotalSource). It also has a variety of HCM plans for midsize and large businesses, enterprises and multinational corporations. Out of every ADP product, ADP RUN is the most comparable to Paychex Flex, matching it nearly feature for feature in terms of HR.

Both Paychex and ADP RUN include plans with a learning management system, applicant tracking system, job board postings, employee handbook builders and more. Both providers also cost more than smaller-scale payroll software like Gusto, OnPay and Square Payroll.

Learn more by reading our RUN Powered by ADP review.

Figure E

Key features of ADP RUN

- Payroll processing and tax filing.

- Direct deposit and check payment options.

- Time and attendance tracking.

- Benefits administration, including health insurance and retirement plans.

- HR tools for managing policies, time off and employee documentation.

- Compliance support, including tax filings and reporting.

- Onboarding and employee self-service portal.

- Integration with popular accounting software.

ADP RUN pricing

ADP offers customized pricing based on the specific needs and size of the business. Businesses are advised to contact ADP directly for a personalized quote.

| ADP RUN pros | ADP RUN cons |

|---|---|

| Four plans with excellent scalability. | No transparent online pricing. |

| Fast direct deposit. | Customer service complaints. |

| Well-reviewed mobile payroll app for employees. | Too pricy for many small and midsize businesses. |

| Integration with most major accounting software product. |

Is Paychex worth it?

Our star rating: 4 out of 5

Paychex’s HR and payroll software, Paychex Flex, is designed to cater to businesses of all sizes, from small startups to large enterprises. If your business requires a comprehensive solution with an extensive range of payroll, HR, benefits administration and compliance support features, Paychex may be a suitable choice. Its robust set of payroll features includes payroll processing, direct deposit, PTO tracking, taxes, and hiring and onboarding support. Paychex also offers a PEO service for small businesses.

Paychex’s payroll tools are fairly comprehensive and fully automated, as are the HR features included with Paychex Flex’s pricier plans. However, Paychex does charge an additional fee for services many other providers include as baseline features, such as general ledger integration.

Learn more by reading our Paychex review.

Paychex pricing

Paychex starts at $39 per month plus $5 per employee per month. Pricing for its two more comprehensive plans isn’t listed online. Contact Paychex to schedule a demo and get a custom quote.

Paychex pros

- Comprehensive solution: Paychex offers a wide range of features, including payroll, HR, benefits administration and compliance support, making it suitable for businesses of all sizes.

- Scalability: The platform is designed to grow with your business, making it a suitable long-term investment for companies with plans to expand.

- Integration: Paychex can integrate with various business apps and accounting software. The vendor’s website lists over 90 integrations that help to streamline your operations.

- Customer support: Paychex has a reputation for excellent customer support, with a dedicated team available to assist with any questions or issues.

- Experience: With over 50 years in the industry, Paychex has established itself as a trusted and reliable provider of payroll and human-capital services.

Paychex cons

- Pricing: Paychex pricing may be less competitive than some alternatives, especially for small businesses with fewer employees or more basic needs.

- Less focus on user-friendly HR management: While Paychex provides robust HR features, some competitors, like BambooHR, may offer more user-friendly HR management solutions.

- Integration limitations: While Paychex does integrate with various business apps and accounting software, some competitors may offer more seamless integration with specific platforms or tools.

Do you need an alternative to Paychex?

When trying to choose payroll software, it is essential to consider your specific needs, feature set and budget. While Paychex offers a comprehensive and scalable solution for businesses of all sizes, it may not be the perfect fit for every organization. We have reviewed several alternatives available, each with its unique advantages and drawbacks depending on your requirements.

Smaller businesses or startups with limited budgets might find more affordable options such as Gusto or QuickBooks more suitable for their needs. These alternatives may still provide essential payroll and HR features without the higher price tag.

If seamless integration with a particular accounting platform or business app is a priority, top payroll software solutions like QuickBooks Payroll (for QuickBooks Online accounting users) or Gusto (with its extensive third-party integrations) could be a better fit.

For organizations that need a more user-friendly HR management solution, BambooHR might be a preferred choice, offering a streamlined and intuitive interface for managing employee records, performance and time-off tracking.

If your business requires more specialized features, such as IT management, Rippling could be an ideal choice as it combines HR and payroll capabilities with IT support.

Review methodology

We have meticulously curated this guide featuring the leading six alternatives to Paychex, taking into account the most salient features. We have undertaken thorough research and assessment of each solution, factoring in customer feedback and ratings from various online sources. Our primary objective is to present an unbiased compilation of payroll and HR options that empowers organizations to make informed choices tailored to their specific requirements.

Learn more by reading our review methodology page.

Source: News