Zoho Books Review (2023): Features, pricing, and more

Zoho Books: Fast facts [Star rating: 4.2]Starting price: $0 for qualifying businesses Key features:

|

Zoho Books’ incredibly comprehensive accounting software is a fantastic choice for small and midsize businesses that want as many accounting features as possible. While setting up its automations can be confusing for first-time accounting software users, Zoho’s streamlined, automated workflows can save valuable time and eliminate redundancies. Plus, Zoho Books is also completely free for businesses with an annual revenue below $50K USD.

Crucially, though, lower-tier Zoho Books plans lack built-in time tracking and project tracking (though users can add a free Zoho Invoice plan to access those features). Zoho Books also syncs with fewer third-party apps than top small-business accounting software companies like Xero — though Zoho Books’ seamless integration with the comprehensive Zoho suite of products should appeal to anyone who loves Zoho’s interface, features and automations.

Jump to:

Zoho Books pricing

Zoho Books has six plans with prices that range from $0 a month to $240 a month. All of Zoho Books’ plans (apart from its free plan) include a 14-day free trial. Users can choose to pay annually at a discounted rate or pay a slightly higher price month to month.

Free

Free for businesses with an annual revenue of <$50K USD.

Key features:

- Access for one user and their accountant.

- Up to 1,000 invoices per year.

- Manual journal entry creation.

- 1099 contractor management.

Standard

Monthly price: $15 (billed annually) or $20 (billed month to month).

All Zoho Books Free features plus:

- Access for three users.

- Up to 5,000 invoices per year.

- 10 custom reports.

- Customer service via email, phone and live chat.

Professional

Monthly price: $40 (billed annually) or $50 (billed month to month).

All Zoho Books Professional features plus:

- Access for five users.

- Unlimited invoices.

- 25 custom reports.

- Basic multi-currency management.

Premium

Monthly price: $60 (billed annually) or $70 (billed month to month).

All Zoho Books Professional features plus:

- Access for 10 users.

- 50 custom reports.

- Free access to Zoho Sign (e-document signing tool).

- Expanded user permission controls.

Elite

Monthly price: $120 (billed annually) or $150 (billed month to month).

All Zoho Books Premium features plus:

- Access for 10 users.

- Unlimited custom reports.

- Shopify store integration.

- Warehouse management for one to five warehouses.

Ultimate

Monthly price: $240 (billed annually) or $275 (billed month to month).

All Zoho Books Elite features plus:

- Access for 15 users.

- Expanded data analytics, custom reports and custom dashboards.

- 25 custom modules.

Zoho Books’ key features

Recurring customizable invoices

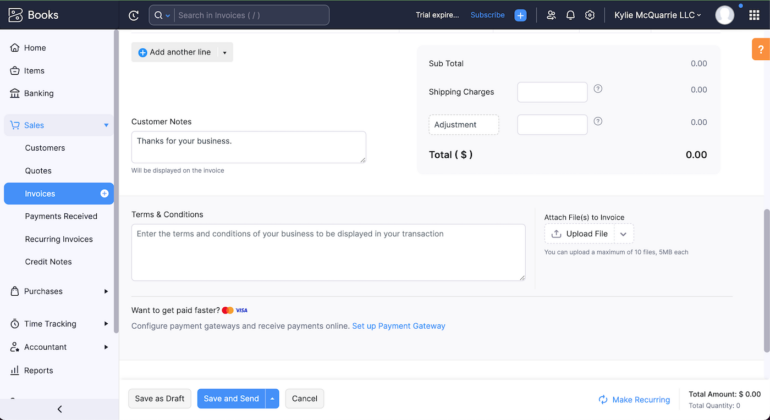

Figure A

Zoho Books’ customizable invoices contain more fields than other comparable invoicing software. For instance, with Zoho Books’ invoices, you can include your business’s personalized terms and conditions, notes for customers, business salesperson or point of contact, shipping charges and up to 10 relevant documents.

The comprehensive fields might make Zoho Books’ invoices seem more complex upfront for first-time business owners who have previously used free invoicing templates with basic details. But Zoho’s level of detail makes its invoices both more complex and potentially more useful than streamlined, freelance-focused invoices from competitors like FreshBooks.

Zoho also has a separate, completely free invoicing product, Zoho Invoice, that integrates with Zoho Books. Zoho Invoice adds crucial features like time tracking and project tracking, plus more payment and billing features.

Cash flow tracking

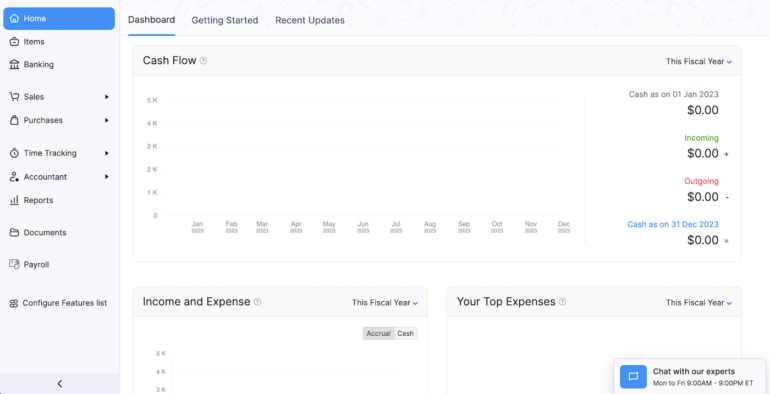

Figure B

Zoho Books doesn’t include cash flow tracking with its free plan or two cheapest paid plans. However, Zoho Books Premium, Elite and Ultimate users can see a quick overview of the business’s cash flow directly from their dashboard.

Accountant access

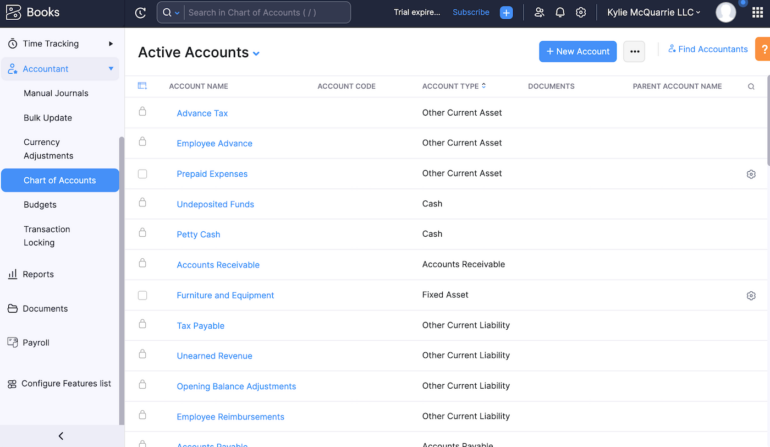

Figure C

All Zoho Books’ plans, including its free plan for microbusinesses, include accountant access. (Most accounting software does the same, though FreshBooks’ cheapest plan is a notable exception that doesn’t include accountant access.) Accountant-friendly features like budgeting, bulk transaction updates and chart of account access are easy to find from the dashboard sidebar.

Timesheet management

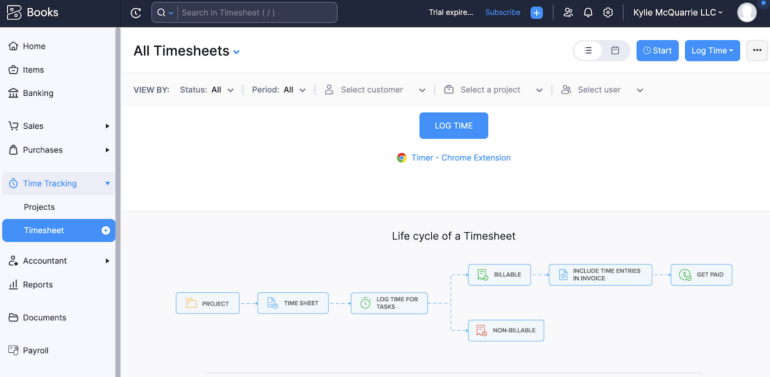

Figure D

Zoho Premium users can track time straight from their Zoho Books dashboard. They can also install Zoho’s time-tracking app, Timer, or use the Timer browser extension. Users of lower-tier plans, including Zoho’s free accounting plan, can’t track time or manage timesheets directly within Zoho Books. However, they can add Zoho Invoice, which is free for most clients and includes project tracking and time tracking.

Online payment acceptance

Some accounting software providers limit you to acceptance payments via Stripe or PayPal only. In contrast, Zoho Books integrates with more than 10 third-party payment gateways, such as Stripe, PayPal, Square, Braintree, Worldpay, Payments Pro, WePay and more.

Payroll integration

For now, at least, Zoho Books’ only payroll integration is with Zoho Payroll, a relatively new product for U.S.-based businesses. As of July 27, 2023, Zoho Payroll is available only for businesses in 12 states, which means Zoho Books isn’t the most flexible choice for multi-state businesses that want to incorporate accounting with payroll.

If you love Zoho Books enough to overlook its limited payroll add-ons, make sure to choose a payroll provider with general ledger exports so you can easily sync your accounting and payroll data.

Additional users

Each Zoho Books plan includes a certain number of users with the base price (including accountant access). For instance, Zoho’s most expensive accounting plan for enterprises, Zoho Books Ultimate, includes 15 users.

However, businesses can choose to add more users for $2.50 per person per month. Only Xero and Wave Accounting, which include unlimited users with every plan, can compete with that price: FreshBooks charges $10 per additional user per month while QuickBooks Online limits user numbers by plan and maxes out at 25.

Zoho Books pros

- 14-day free trial with every plan (not applicable to the free plan).

- Six plans for maximum scalability.

- Accountant access with every plan.

- Unlimited users with each plan ($2.50 per month per user).

- Free Zoho Books webinars every Tuesday and Thursday.

- 24/5 customer service with live chat available Monday through Friday, 9 a.m. to 9 p.m.

Zoho Books cons

- No cash flow forecasting with free plan or with two cheapest paid plans.

- Timesheet management not available with free plan or cheapest paid plan.

- Automations and setup can be complex for first-time accounting software users.

Top Zoho Books alternatives

Plan and pricing information up to date as of 7/26/2023.

QuickBooks Online

Starting price: $30 per month.

QuickBooks Online, Intuit’s popular cloud-based accounting software, is among the only accounting software companies whose base plan can compete with Zoho Books’ in terms of sheer features.

QuickBooks Online’s cheapest plan costs $30 per month, which is one of the highest starting prices of any small-business accounting software. For that price, though, users get some crucial bookkeeping and accounting features Zoho Books doesn’t include with its lower-tier plans:

- Built-in time tracking.

- Receipt capture and upload via the QuickBooks Online app.

- Basic cash flow tracking.

- Payroll integration with QuickBooks Online Payroll.

Our QuickBooks Online review has more information on QuickBooks’ features, plans, pros and cons.

Xero

Starting price: $13 per month.

Zoho Books’ free plan aside, Xero has the lowest starting price of any provider on our list. Its freelance-friendly starter plan, Xero Early has a few crucial limitations. For instance, it limits users to sending just 20 invoices each month and entering just five bills per month.

But Xero’s accounting software has some stand-out features for product-based business owners (such as Etsy and eBay sellers) at a lower price than either QuickBooks Online or Zoho Books:

- Built-in inventory tracking.

- Cash flow forecasting.

- Bill and receipt capture via Hubdoc.

- Payroll integration with Gusto (among others).

Our Xero review has more information on Xero’s features, plans, pros and cons.

FreshBooks

Starting price: $17 per month.

More so than Zoho Books, Xero or even QuickBooks, FreshBooks focuses on providing exceptional invoicing and billing software. Like Zoho Books, FreshBooks’ starting plan includes automated recurring invoicing and automatic late payment reminders. Unlike Zoho Books, though, FreshBooks’ invoices include crucial freelance features:

- Automatic scheduled late fees.

- Deposit acceptance.

- Project-based time tracking with invoice integration.

- Project-based budget and billing management.

- Payroll integration with Gusto.

Our FreshBooks review has more information on FreshBooks’ features, plans, pros and cons.

Our methodology

To research and write our Zoho Books review, we thoroughly reviewed Zoho’s plan and pricing information, viewed how-to videos and tried the software ourselves using Zoho Books’ 14-day free trial. We also read verified user reviews on the App Store, Google Play, Gartner Peer Insights, Trustpilot and other aggregate rating sites.

To calculate our star rating for Zoho Books, we relied on an internal algorithm that scores accounting software in the following categories:

- Pricing (weighted to 25%).

- Accounting features (weighted to 35%).

- Ease of use (weighted to 15%).

- Customer service (weighted to 15%).

- Our expert’s hands-on experience (weighted to 10%).

Read next: The Top Invoicing Apps for Small Businesses and Self-Employed Individuals

1

Acumatica Cloud ERP

Acumatica Cloud ERP offers powerful finance and business intelligence tools to streamline company-wide accounting processes. Track costs, control billing, and manage time/expenses with multi-currency support and powerful financial reports. Acumatica makes real-time financial data available anytime, anywhere, on any device. Harness this data to make informed accounting decisions, reduce workloads, close the books faster, accelerate growth, and transform how you do business in the digital economy.

2

Multiview ERP

Multiview Financials’ ERP provides a single point of truth within your organization, enabling visibility across divisional, regional, or product line silos. It goes beyond traditional finance and accounting to add the sophisticated capabilities that today’s complex organizations demand.

3

QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

4

Oracle NetSuite

NetSuite cloud financials and accounting software helps finance leaders design, transform and streamline their processes and operations. NetSuite seamlessly couples core finance and accounting functions, which improves business performance while reducing back-office costs. With real-time access to live financial data, you can quickly drill into details to quickly resolve delays and generate statements and disclosures that comply multiple regulatory financial compliance requirements.

Source: News